The Thinly Disguised Global Authoritarian Agenda we should all fear

It was almost one year ago today that Larry Fink, CEO of Blackrock was interviewed about his views on authoritarianism. His answer was a shocking eye-opener.

“Markets don’t like uncertainty,” he responded. “Markets like totalitarian governments where you have an understanding of what’s out there and obviously the whole dimension is changing now with the democratization of countries, and democracies are very messy as we know here in the United States.”

🚨VIDEO: @blackrock’s #LarryFink: “Markets don’t like uncertainty. Markets like totalitarian governments.” His solution to this “problem” is to control funds and economies with “stakeholders” like the UN and China’s CCP. Larry is ushering in pic.twitter.com/fNfxsIZonR…

— State Financial Officers Foundation (@SFOF_States) February 15, 2023

Its not conspiracy theory to interpret his remarks when he says “markets” that he means “Blackrock”. After all, Blackrock owns up to 15 percent of all major global corporations in the world, so its no stretch to say Blackrock is the market.

So might this sentiment explain why, in the developed world, there is a definitive trend whereby conservative leaning governments are rebranding themselves as the parties of absolutes, where issues such as abortion, LGTBQ2 rights and immigration are being retrograded to 1950’s levels of intolerance?

If we were to examine the evolution of the tonal direction of conservative platform rhetoric since 1980, we see a clear trend – almost consistent with the rise and dominance of Blackrock and Fidelity in corporate ownership – away from traditional values toward more extreme nationalism, censorship and legal interference in the autonomy of the individual.

We know from history that banks like Rothschildes, JP Morgan and Goldmans Sachs, who are known to finance wars on both sides, could deal directly with authoritarian regimes whereas democratic institutions were by definition less accessible to direct negotiation by financiers of the war machine.

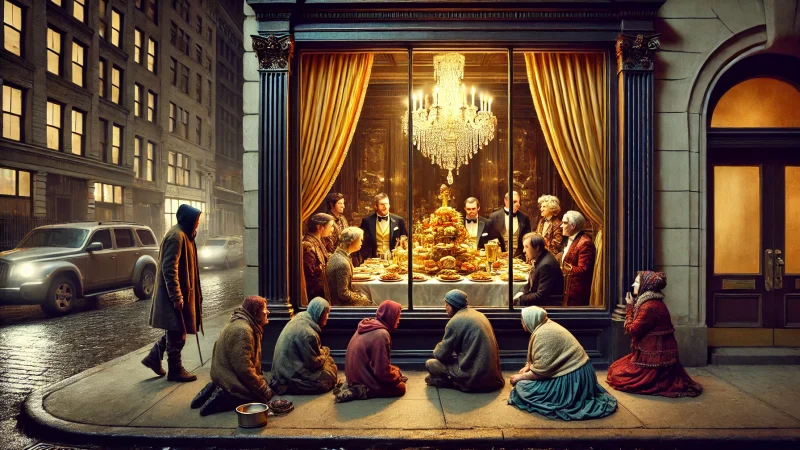

From a humanist perspective, it is also historically evident that wealth and the corporations it capitalizes have no humanity, because the CEO of a corporation must always outperform its peers else be replaced by someone who did.

Environment, social good, and corporate governance are always seconded to the imperative of making money. Thus “ESG” has become the hottest greenwash label such corporations desperately vie for to cover up the absolute sham such conscientious governance principles exist in corporations.

When considering the acceleration into climate destabilization that is driven by the corporate financial class, it falls within the interest of every member of the public who does not contribute to the financial system that can change the tides of public sentiment through the sheer scale of their media budgets to really ask, Where is this all heading?”

As an optimistic cynic, I can’t help but reach the same stark conclusion, day after day, that the intention here is to launch a “reset” wherein the absolute authority of government replaces the relative freedom of expression we enjoy today, and the “you will own nothing and you will be happy” slip from the World Economic Forum seeks to insinuate itself into our lives with greater and greater force.

The net effect of driving the polarity of us vs them identity politics into the zeitgeist of modern media discourse is that popular protest has been undercut because one must be identified as either Liberal or Conservative. Thus the prevalence of the derogatory “libs” and “cons” in extremist content. We are thus kept divided as “the public”.

When looking over the fence at your neighbour with derision because they fly a F*CK (insert your national leader here) flag or post anti- (immigration, abortion, LGTBQ2) signs on their lawns or in their windows, it behooves us to recall that we are all being targeted by the elite class of global oligarchs like Larry Fink for inclusion or exclusion in this newly reset society. Most of us make the mistake of presuming we will of course be included and those damn libs or cons will be excluded because obviously!”

But such is not the case. And the division of the population in this camp or that camp is the strategy by which they seek to defuse and enfeeble the only thing that could undermine their drive toward global authoritarianism: a united public sentiment.

UZ5MiLDiUPP