OECD Composite indicates Canadian crash ahead

Its more than a little bit disturbing that the recently published chart below by the Organisation for Economic Co-operation and Development (OECD) shows Canada’s economy is heading for a major contraction. In fact, Canada appears to be leading the G7 toward a substantial correction.

But are we surprised?

No. On the contrary, this is the inevitable outcome when the Bank of Canada imposes higher interest rates on Canadians to socialize the cost of stimulating economic growth with low interest rates accompanied by central bank balance sheet expansion i.e. Quantitative Easing i.e Financial Stimulus.

It is difficult for the average Canadian taxpayer to apprehend the relationship among central bank policies, interest rates, inflation, economic velocity and government debt, since (by design, if you’re cynical) messaging from central banks and commercial bank economists tend to conflict in explaining the central bank policy moves.

According to Carmen Reinhart and Belen Sbrancia in the 2015 IMF working paper entitled The Liquidation of Government Debt, “High public debt often produces the drama of default and restructuring. But debt is also reduced through financial repression, a tax on bondholders and savers via negative or below- market real interest rates.”

This is in reference to the periods of broad financial stimulus when central banks are borrowing from their affiliated Treasurys aggressively, which they can only do when negative real interest rates are attached to that debt. When the central banks keep interest rates negative in real terms, they ensure the interest rate expense is kept low which automatically penalizes commercial banks, savers, pensions, and all fixed income product beneficiaries.

The result of such stimulus is now proven to result in runaway inflation, which central banks then respond to with higher interest rates under the guise of taming inflation, but really to compensate the commercial banking sector and institutional fixed income issuers for the last decade of low interest rates and their oppressive effect on bank earnings.

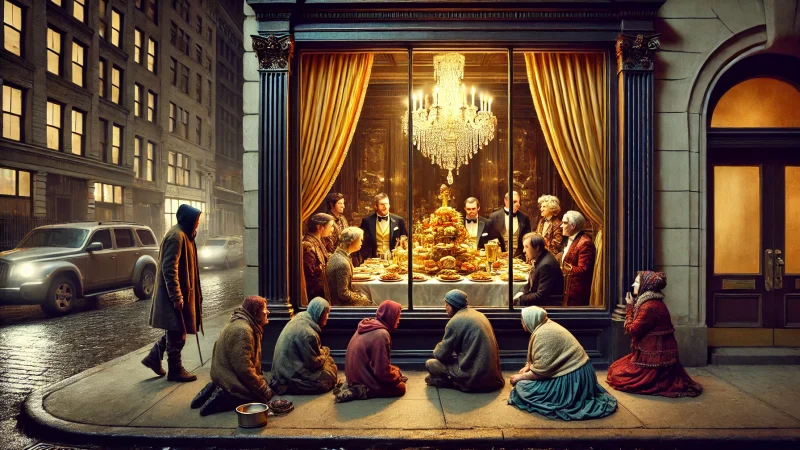

But the important takeaway here for the average citizen is that the central banks can be seen to be implementing policies that protect the interest of the institutoinal banking and investing industries by foisting the cost of stimulus onto the consumer.

Granted, low interest rates do achieve a benefit to the consumer by making the cost of borrowing to buy a house lower, but that is almost simultaneously offset by the higher home prices the resulting buying frenzy induces. So that benefit is largely cancelled out by the fact that consumers are overpaying for their homes, which triggers defaults and foreclosures when the inevitable higher rates are introduced to combat inflation.

Let us pause here for moment to define inflation:

First, there are two main types of inflation that are related yet different. Monetary Inflation is the act of creating money and credit in the financial system by central banks borrowing from their government treasurys, which cause an increase in the money supply broadly in the economy.

Price Inflation is what results when the increased money supply begins to compete for goods and services which typically cannot be increased by monetary inflation – at least, not at the same pace.

So central banks deploy low interest rates and financial stimulus to recduce the cost of servicing the increased debt they have taken on in previous periods of stimulus and borrowing. The then compensate the banking system for enduring the period of lower rates, which directly undermines bank revenue for the duration, by raising rates, which automatically and directly increases commercial bank earnings thanks to the higher spreads on what the bank pays versus what they lend at.

But price inflation has a parallel predatory effect on consumers as demonstrated by Loblaws hammering home outsized earnings by cloaking the increased margins they can charge during inflationary policy periods under the guise of inflation.

My long-winded and hopefully not too convoluted argument here is that we, as citizens, should be more outraged by our Bank of Canada pandering so brazenly to our elite financial families and institutions while we cope with the undisclosed austerity under which we are forced to finance what amounts to private profiteering amid financial repression.

The complexity of the matrix of government borrowing/stimuli, interest rates and inflation is engineered to befuddle the understanding by average citizens of what is really happening.

At the end of the day, these central banks act in the interests of the financial industry to cause periods of boom and bust for consumers that result in our assets being confiscated by the upper echelons of the great financial pyramid.

And just like a pyramid, the minority uppermost blocks are supported entirely by the collective unrelenting strength of those on the bottom.