The Next Correction is Almost Here

The Gathering Storm

Among the byproducts of the ersatz economics rampant in government policies is the sustainability of what we refer to in polite company as “Quantitative Easing”.

It is essentially the fabrication of capital and credit – “liquidity”, in the modern vernacular – through the collusion between the central banks and the treasury departments of developed nations on one side, and the banking system on the other side.

It is a ponzi scheme of biblical proportions because the treasury is issuing debt backed by the government which is then auctioned off by the Fed to the annointed co-conspiracists in the banking community who then “buy” the treasury bills that the Fed auctions off, creating the illusion of demand for this Tier 1 capital.

the other co-conspirators are other central banks, all of whom buy each others’ debt to varying degree depending on geo-political ranking, and thus the global illusion of deficit capitalization of governments is kept afloat by the real appearance of “everybody’s doing it”.

Of course, the economists provide the music to such pagentry, lending it the mantle of academic credibility from that utterly contemptible quarter.

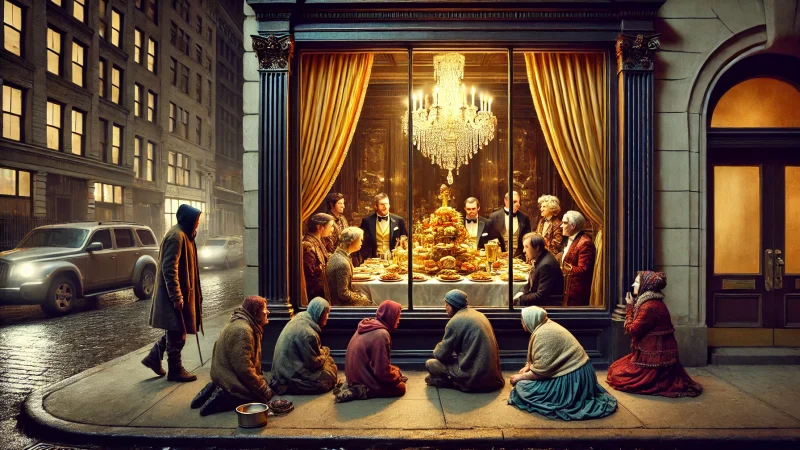

The by-product of this epic game of musical chairs is price inflation. Economists do not currently subscribe to the idea that monetary inflation must necessarily result in proportional price inflation, because that would contradict the necessary lie for all of this to remain plausible to the average Joe on Main Street.

The most recent Consumer Price Index number of 6.2% reported by the Fed – the biggest one month surge in 30 years – is the canary in the coal mine keeling over because there is indeed the smell of something rotten in the global financial well.

The meltdown will once again be catalyzed by the housing industry, and the preliminary signs of this unfolding are here: multiple real estate development firms in China going delinquent, increasing “time on market” numbers from the US, rising interest rates amid excess inventory….I could go on.

This is what the continuous fabrication of liquidity does: it creates demand for commodities such as houses that are neither affordable nor needed by the population now nearing maximum.

It is for this reason that the G7 governments are in collusion on the permission of the absolute explosion in synthetic assets like crypto currencies, NFT’s and other forms of “assets” that have no actual utility or tangible existence. Cryptocurrencies are the most improbable fraud ever – mere snippets of code generated by algorithmic puzzles to create arbitrary values determined only by the pool of speculators willing to support the illusion of value.

Who can blame them? They are only imitating what the Fed and governments are doing through quantitative easing. It’s all a fraud.

And that is why, as the music slows, there will not be nearly as many chairs required for the game to resolve peacefully. Conspiracy theorists would say this is all by design by the global elite.

I have no interest in conspiracies. Only in crimes in progress.

Which is why I moved to the country to raise food and meditate.